The American Dream, Out of Reach

24 Oct 2023

24 Oct 2023 by Luke Puplett - Founder

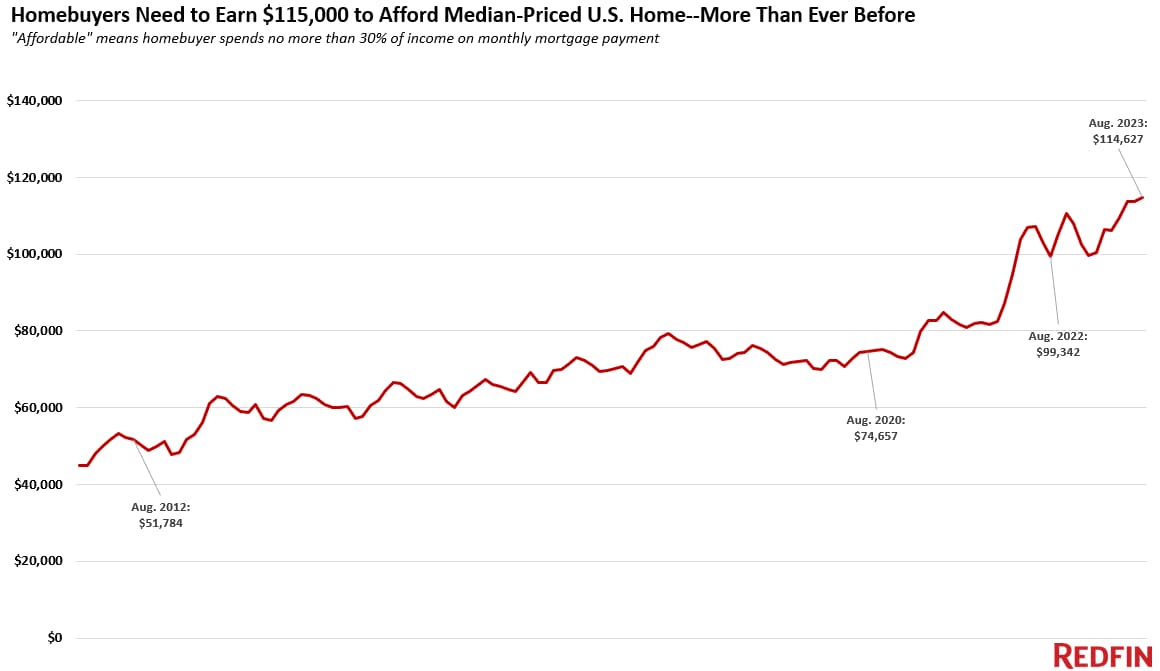

The soaring cost of housing is putting homeownership out of reach for many Americans, especially first-time buyers. As the article details, the typical homebuyer now needs to earn $115,000 per year to afford the median-priced home in the US. That's a 15% increase from just a year ago and over 50% more than at the start of the pandemic.

This squeeze between stagnant wages and skyrocketing home prices illustrates a key tension in the inflation fight. The theory goes that rising interest rates will dampen demand, bringing down prices and wages, thus breaking the cycle of inflation. But real-world effects may not be so straightforward. As more Americans find that buying a home - a centerpiece of wealth creation - is out of reach, pressure will mount for higher pay. "I can't afford to have kids" is a pretty good way to start a conversation about a pay raise. While rising rates may temper housing prices at the margins, if wages keep increasing to compensate, it could still fuel overall inflation.

The housing affordability crunch thus reveals both the promise and the limitations of relying on interest rates alone to tame inflation. More targeted solutions like boosting housing supply and linking wage growth to productivity gains may be necessary as well. But for now, high rates risk putting the American dream of homeownership out of reach for many.

Elon Musk recently implored people to have more children, warning of a "population collapse" if birth rates continue to decline. But for many young Americans, the soaring cost of housing is a major barrier to starting a family. Countries like Japan and China demonstrate the economic perils of demographic decline due to low birth rates. Japan's aging population and shrinking workforce has contributed to weak economic growth for decades. China's previous one-child policy also led to a rapidly aging population, prompting the government to relax restrictions. But unless housing and childcare become more affordable, financial constraints may hinder Americans' family plans regardless of Musk's pleas.

Ultimately, the dream of homeownership and financial stability remains central to many Americans' vision for starting and providing for a family. But with housing affordability stretched to the limits, that dream risks sliding out of reach. New solutions - whether boosting supply, linking wages to productivity, or better family benefits - will be needed to secure this foundation of the American future.

That's lovely and everything but what is Zipwire?

Zipwire Collect handles document collection for KYC, KYB, AML, RTW and RTR compliance. Used by recruiters, agencies, landlords, accountants, solicitors and anyone needing to gather and verify ID documents.

Zipwire Approve manages contractor timesheets and payments for recruiters, agencies and people ops. Features WhatsApp time tracking, approval workflows and reporting to cut paperwork, not corners.

Zipwire Attest provides self-service identity verification with blockchain attestations for proof of personhood, proof of age, and selective disclosure of passport details and AML results.

For contractors & temps, Zipwire Approve handles time journalling via WhatsApp, and techies can even use the command line. It pings your boss for approval, reducing friction and speeding up payday. Imagine just speaking what you worked on into your phone or car, and a few days later, money arrives. We've done the first part and now we're working on instant pay.

All three solutions aim to streamline workflows and ensure compliance, making work life easier for all parties involved. It's free for small teams, and you pay only for what you use.