ON UK Labour Market Report September 2024: Key Insights for Employment Agencies

10 Sep 2024

10 Sep 2024 by Luke Puplett - Founder

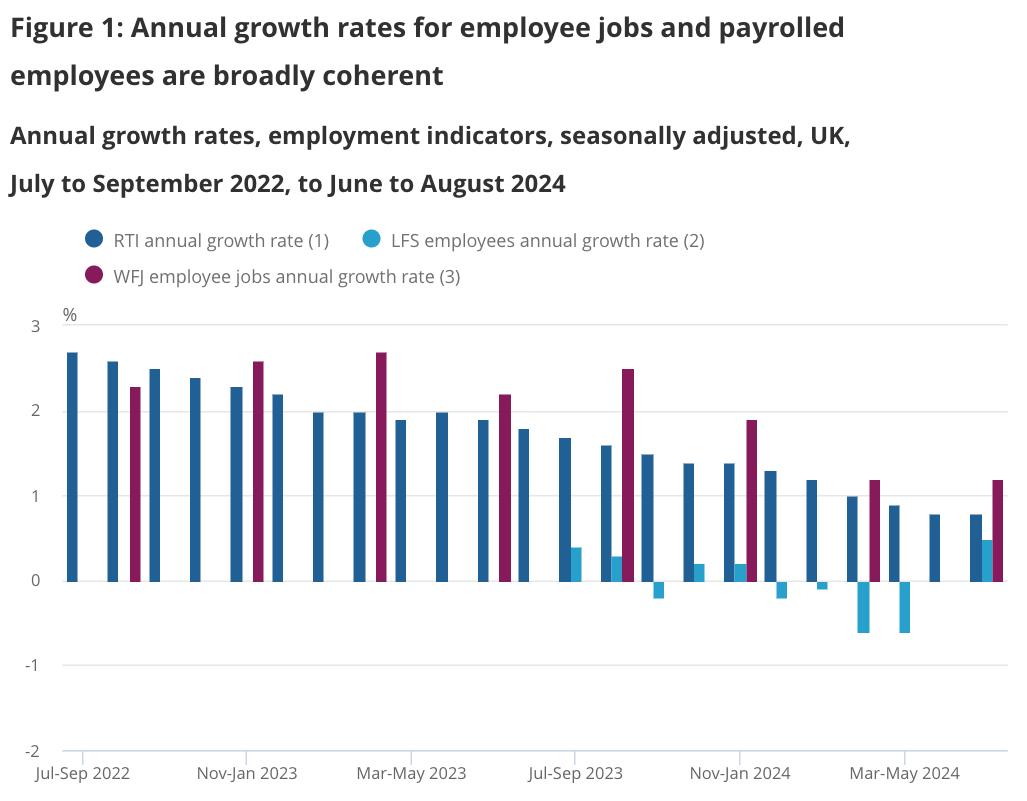

"There has been a consistent slowdown in annual growth across all three sources over the last year."

The latest UK labour market data shows a mixed picture. While the unemployment rate fell to 4.1% in May-July 2024, the economic inactivity rate rose to 21.9% over the same period.

The economic inactivity rate measures the percentage of the working-age population (16-64 years old) who are neither employed nor actively seeking work.

Key takeaways:

-

→ Payrolled employees decreased slightly month-on-month but rose year-on-year. In July 2024, payrolled employees decreased by 6,000 (0.0%) from June, but increased by 203,000 (0.7%) from July 2023. The early estimate for August saw a decrease of 59,000 (negative 0.2%) compared to July, but an increase of 122,000 (0.4%) compared to August 2023.

-

↘ Vacancies continue to decline but remain above pre-pandemic levels. The number of vacancies fell by 42,000 in June-August 2024, reaching 857,000. This marks 26 consecutive quarters of decline, but they still remain higher than before the pandemic.

-

↗ Annual growth in earnings remains positive but has slowed. Annual growth in regular pay (excluding bonuses) was 5.1% in May-July 2024, while total pay (including bonuses) saw an annual growth of 4.0%. However, adjusted for inflation, real-term growth in regular pay was 2.2% and total pay was 1.1%.

Challenges remain in comparing labour market data sources. "There have been ongoing challenges in assessing the coherence between these statistics," the report states.

The Labour Force Survey (LFS) is undergoing improvements. The ONS acknowledges the challenges with the LFS and has been working to improve its quality. The report states that "we recommend using [LFS data] as part of our suite of labour market indicators, alongside Workforce Jobs (WFJ), Claimant Count data, and Pay As You Earn (PAYE) Real Time Information (RTI) estimates."

The Claimant Count increased in August. The count rose to 1.792 million, reflecting both monthly and annual increases.

Further developments:

-

A reweighting exercise for the LFS is planned, aiming to improve coherence with other data sources.

-

The ONS is refreshing its work on reconciling employment estimates from the LFS and WFJ.

-

The report emphasizes the importance of using multiple data sources to gain a comprehensive understanding of the UK labour market.

See the full report on the ONS, here: ONS Labour Market Report

That's lovely and everything but what is Zipwire?

Zipwire Collect handles document collection for KYC, KYB, AML, RTW and RTR compliance. Used by recruiters, agencies, landlords, accountants, solicitors and anyone needing to gather and verify ID documents.

Zipwire Approve manages contractor timesheets and payments for recruiters, agencies and people ops. Features WhatsApp time tracking, approval workflows and reporting to cut paperwork, not corners.

Zipwire Attest provides self-service identity verification with blockchain attestations for proof of personhood, proof of age, and selective disclosure of passport details and AML results.

For contractors & temps, Zipwire Approve handles time journalling via WhatsApp, and techies can even use the command line. It pings your boss for approval, reducing friction and speeding up payday. Imagine just speaking what you worked on into your phone or car, and a few days later, money arrives. We've done the first part and now we're working on instant pay.

All three solutions aim to streamline workflows and ensure compliance, making work life easier for all parties involved. It's free for small teams, and you pay only for what you use.