MLR 2017: Remote AML Compliance for Art Galleries

08 Apr 2025

08 Apr 2025 by Luke Puplett - Founder

Staying Compliant with MLR 2017: How Zipwire Collect Simplifies AML for UK Art Galleries

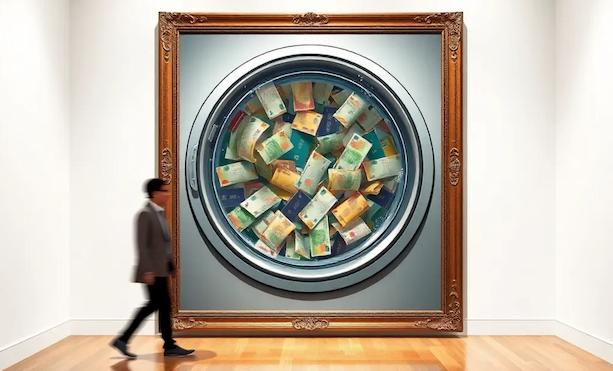

In 2025, UK art galleries face mounting MLR 2017 pressure—fines, reputational damage, or prosecution loom for deals over €10,000. With HMRC tightening scrutiny and sanctions reporting hitting May 14, 2025, slow, error-prone in-person checks fail today's global art market. Zipwire Collect transforms compliance with remote, digital-first tools.

For Art Market Participants (AMPs), Customer Due Diligence (CDD), record-keeping, and sanctions checks are non-negotiable. Yet conventional in-person verification creates delays and risks—especially when buyers and sellers never meet face-to-face.

Enter Zipwire Collect—a remote, digital-first solution that transforms MLR compliance from burden to advantage. Whether your client's in London or Dubai, our technology ensures seamless, secure compliance without physical presence.

Understanding MLR 2017 for Art Market Participants

MLR 2017 applies to any gallery or dealer (an AMP) trading art worth €10,000 (£8,500) or more. This covers traditional artworks like paintings and sculptures—but not artists selling their own work.

Key compliance requirements include:

-

Registration & Risk Assessment: Register with HMRC and maintain updated risk assessments for money laundering exposure

-

Customer Due Diligence (CDD): Verify customer identities and ownership structures before sales, with enhanced checks (EDD) for high-risk clients like PEPs

-

Record Keeping: Maintain all verification records and transaction details for 5 years

-

Suspicious Activity: Report concerns to the NCA immediately via SARs

-

Sanctions Compliance: From May 14, 2025, screen clients against sanctions lists and report matches to OFSI

Non-compliance risks civil penalties up to £13,000, business bans, or criminal prosecution with up to 7 years' imprisonment. With HMRC increasing checks, robust compliance systems are essential.

The Remote Compliance Challenge

Today's art market is global—a Tokyo collector might purchase through a New York advisor without ever visiting your London gallery. Yet MLR 2017 demands the same rigorous compliance whether your client is local or overseas.

Traditional in-person verification creates three critical problems:

-

Lost Sales: Waiting for in-person verification delays deals and frustrates international buyers

-

Compliance Risks: Manual document checks across jurisdictions increase error chances and complicate sanctions screening

-

Resource Drain: Maintaining paper trails and chasing documents worldwide consumes staff time better spent on art deals

These challenges intensify as galleries expand internationally and sanctions requirements tighten. A modern, digital solution is essential for galleries serious about global growth and compliance.

How Zipwire Collect Ensures MLR Compliance

Remote CDD & Identity Verification

Through our Yoti integration, clients complete secure identity checks via mobile selfie verification. AI-powered document analysis confirms authenticity instantly, meeting HMRC's verification standards without physical presence.

Enhanced Due Diligence & Sanctions

Smart rules automatically trigger additional checks for high-risk clients (PEPs) and handle sanctions screening—ready for the May 2025 OFSI requirements. Our system adapts document requests based on risk levels and jurisdictions.

Secure Record-Keeping

Every verification step, document, and decision is encrypted and stored for the mandatory 5-year period. Your complete compliance trail stays organized and HMRC-ready, with no paper files to manage.

Suspicious Activity Monitoring

Automated checks flag potential concerns, supporting your SAR reporting obligations to the NCA. Our system helps spot patterns that might need investigation, reducing compliance risk.

Benefits Beyond Basic Compliance

Audit-Ready Efficiency

Transform compliance from burden to business advantage:

-

Automated document collection eliminates manual chasing and follow-ups

-

AI-powered verification replaces time-consuming manual checks

-

Digital storage means instant access to records during HMRC inspections

Global Growth

-

Verify clients anywhere with just a mobile device and camera

-

Choose from four global cloud storage locations for data sovereignty

-

Pay only for what you use—no monthly fees during quiet periods

Client Trust

-

Professional, step-by-step digital verification process

-

Secure, encrypted handling of sensitive information

-

Faster deal completion without compromising compliance

Risk Protection

-

Standardized processes cut errors, shielding you from £13,000 HMRC fines

-

Automatic updates keep you aligned with evolving regulations

-

Expert support tackles your compliance challenges

Turn MLR Compliance Into Your Competitive Edge

As HMRC tightens oversight and May 2025's sanctions requirements approach, your gallery needs more than just basic compliance—you need a competitive advantage. Zipwire Collect delivers both.

Transform your gallery's compliance with:

-

Remote identity verification that works anywhere, anytime

-

Automated PEP and sanctions screening for May 2025 readiness

-

Five-year encrypted storage for HMRC-ready records

-

Pay-as-you-use pricing with no monthly commitments

Don't let MLR 2017 hold back your gallery's growth. Join forward-thinking art dealers who've already transformed compliance from burden to business advantage with Zipwire Collect.

Start Your Compliance Transformation

That's lovely and everything but what is Zipwire?

Zipwire Collect handles document collection for KYC, KYB, AML, RTW and RTR compliance. Used by recruiters, agencies, landlords, accountants, solicitors and anyone needing to gather and verify ID documents.

Zipwire Approve manages contractor timesheets and payments for recruiters, agencies and people ops. Features WhatsApp time tracking, approval workflows and reporting to cut paperwork, not corners.

Zipwire Attest provides self-service identity verification with blockchain attestations for proof of personhood, proof of age, and selective disclosure of passport details and AML results.

For contractors & temps, Zipwire Approve handles time journalling via WhatsApp, and techies can even use the command line. It pings your boss for approval, reducing friction and speeding up payday. Imagine just speaking what you worked on into your phone or car, and a few days later, money arrives. We've done the first part and now we're working on instant pay.

All three solutions aim to streamline workflows and ensure compliance, making work life easier for all parties involved. It's free for small teams, and you pay only for what you use.